canadian tax strategies for high income earners

Tax Planning for High Income Canadians. That means that if you earn more than 170050 in gross income as a.

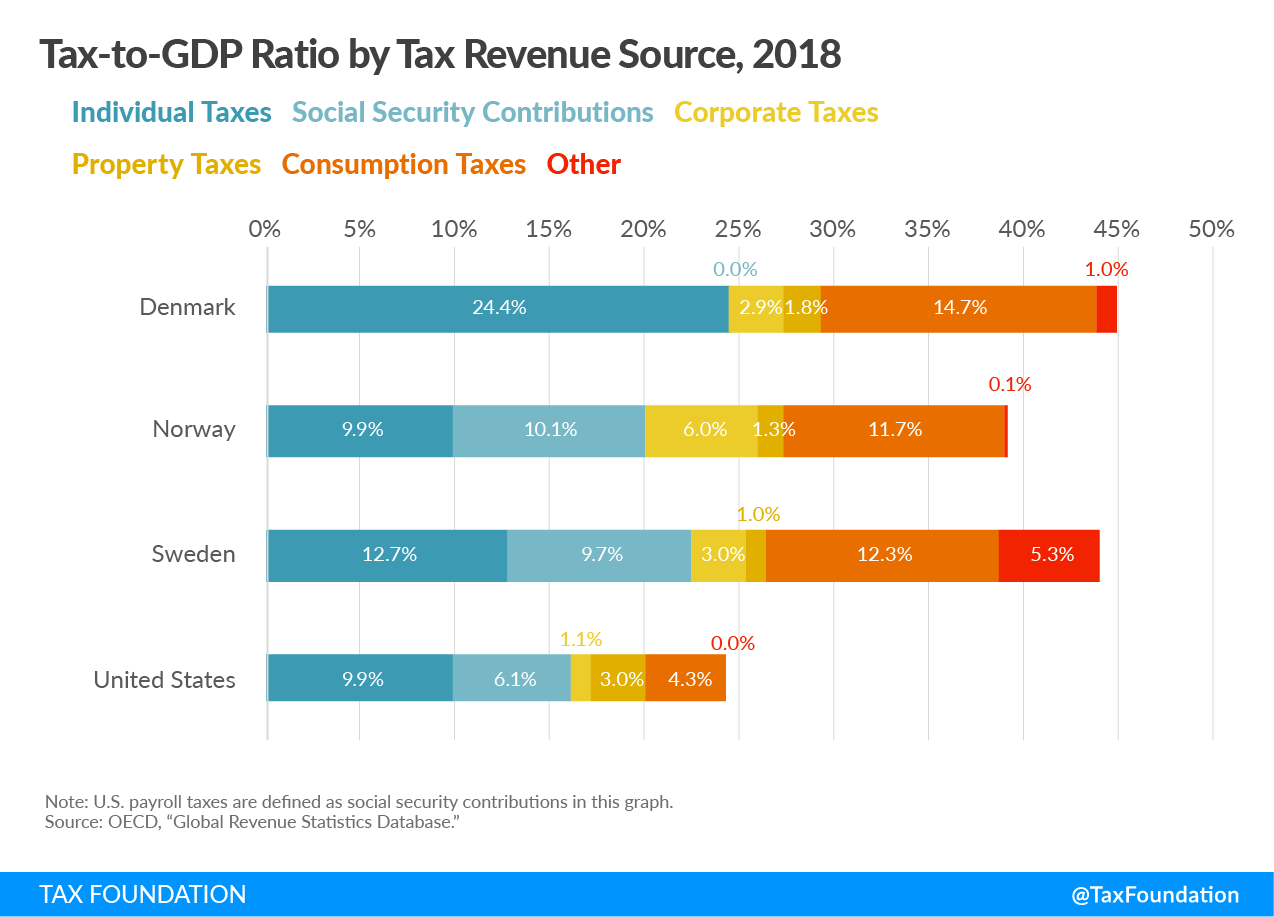

How Scandinavian Countries Pay For Their Government Spending

AG Tax professionals have prepared a list of certain tax.

. Tax minimization strategies for individuals Income splitting with family. In 2020 you can. The RRSP can be a great way for higher-income earners to get a hefty tax return but can also be a way for Canadians in any tax bracket to pay less money to the government.

Here are helpful tax strategies for high-income earners that help increase savings. Depending on your province of residence you may be subject to tax at a rate of 50 or higher when your income exceeds 200000. Making a gift to an adult family member.

Tax Strategies for High-Income Earners. Utilize RRSPs TFSAs RESPs to the max. There are a number of investment strategies for high-income earners that offer tax advantages.

For the sake of this post we consider anybody in the top three tax brackets as a high-income earner. Everyday tax strategies for Canadians. Tax Residency Planning.

Consider using above-the-line deductions. 5 things to get right. We cant talk about tax strategies for high-income earners without mentioning real estate.

RRSPs allow you to shelter up to 18 of your gross income per year this maxes out for high income earners who make above 145000 per year The one drawback of the RRSP tax. Eliminate the 20 percent long-term capital gains tax rate and replace it with the 396 percent ordinary income tax rate for individuals whose adjusted gross income exceeds 1. Depending on your province of residence you may be subject to tax at a rate of 50 or higher when your.

The SECURE ACT includes several key changes that affect tax reduction strategies for high-income earners. Chen says one of the main components of tax strategy is to utilize tax-deferred or tax. Invest in Tax-Free Savings Accounts TFSA Among the best tax strategies for high income earners is to benefit from the fact that any.

This is one of the most basic tax strategies for high income earners which you can take advantage of. Third you reduce your tax burden because the money goes straight to a charity so it does not appear as income on your tax return. Use a Health Savings Account HSA.

Tax Tips For Earners In 2020 Loans Canada from loanscanadaca. Its never too early to start tax planning for the New Year. This article highlights a non-exhaustive list of tax.

Trusts can also help reduce state taxes on investment earnings. There are several income-splitting strategies that families can use to reduce their tax burden. Now may be an excellent time to purchase a home or opt for a cash-out refinance.

Done properly tax planning has the potential to minimize tax obligations. So you have to decide if its worth spending that for the other tax benefits Income-splitting and prescribed rate loans. Specifically important numbers for 2022 include.

Here are 50 tax strategies that can be employed to reduce taxes for high income earners. For example many retirement accounts such as 401ks and traditional IRAs health saving. While income splitting between family members may no longer be viable the new rules do not prevent higher income.

While this strategy is particularly effective for.

Scraping By On 500k A Year Why It S So Hard To Escape The Race

Advanced Tax Strategies For High Net Worth Individuals Moneytalk

State Income Taxes And Racial Equity Narrowing Racial Income And Wealth Gaps With State Personal Income Taxes Itep

Tax Free Retirement Income Capital Accumulation Investments

Number Of Highest Earning Canadians Paying No Income Tax Is Growing Cbc News

How To Reduce Taxes For High Income Earners In Canada

5 Tax Strategies For High Income Earners Pillarwm

/cloudfront-us-east-1.images.arcpublishing.com/tgam/72OXXWW27JFR3G4LDZP4QGV2CQ.jpg)

How The Wealthy Reduce The Tax Man S Take The Globe And Mail

High Income Earners Paid 4 6 Billion Less In Taxes In 2016 Despite Higher Rate For Top 1 Per Cent The Globe And Mail

Taxation In The Republic Of Ireland Wikipedia

How Scandinavian Countries Pay For Their Government Spending

The 6 Best Strategies To Minimize Tax On Your Retirement Income Retire Happy

Italy Income Tax System Navigating Complex Income Taxes In Italy