maricopa county irs tax liens

A tax lien was sold on 2102015 to CP Buyer Number 5312 on every. Ad See Anyones Lien Records.

Tax Liens Tax Lien Foreclosures Arizona School Of Real Estate And Business

Tax Lien Web The Maricopa County Treasurers Tax Lien Web application allows you to monitor your CP Buyer account with Maricopa County.

. As you might have gathered a tax lien is simply a lien placed on property by the IRS or Maricopa County Arizona tax authorities to gather taxes that the property-owner has failed to pay. Please mail completed forms to Maricopa County Treasurer 301 W Jefferson St 140 Phoenix AZ 85003 or fax to 602 506-1102. Free Information and Preview Prepared Forms for you Trusted by Legal Professionals.

The Tax Lien Sale will be held on February 9. Lien Records are public records which can be viewed online. All requests regarding tax liens such as requests for assignments sub-taxing reassignments merge vacate and Treasurers deeds should be sent to Maricopa County 301 W Jefferson St.

Authority does not a county board of guys in some irs in an irs. Enter the property owner to search for. What do you mean the tax lien was the result of an internal auditdoesnt make sensewhat you may mean is that IRS either caught you up in 1099-B matching or you didnt.

This page provides links to the IRS Tax. Or IRS Form W-8BEN-Efor Foreign Entities. When a Maricopa County AZ tax lien is issued for unpaid past due balances Maricopa County AZ creates a tax-lien certificate that includes the amount of the taxes owed plus interest and.

Enter a Name Find Anyone. The Treasurers tax lien auction web site will be available 1252022 for both. Enter Name Search Risk Free.

Maricopa County Treasurer co Research Material Purchasing 301 W Jefferson Suite 100 Phoenix Arizona 85003 What is a tax lien also known as a certificate of purchase. Each county should have. In maricopa county irs tax liens investing.

Maricopa county treasurers home page. See Cell Phone Current Address Email Criminal Offenses Age and More. The Tax Lien Sale of unpaid 2020 real property taxes will be held on and closed on Tuesday February 8 2022.

The process of imposing a tax lien on property in maricopa county arizona is typically fairly simple. Release of State Tax Lien Payment in full with Cash or Certified Funds Upon receipt of a cashiers check or certified funds the Department of Revenue will immediately provide a Notice of Intent. Ad Get Access to the Largest Online Library of Legal Forms for Any State.

Do not include city or apartmentsuite numbers. Ad Find Anyones Tax Liens Records. Your Treasurers Office Meet Your Treasurer Treasurers - 1871 to Present IRS Forms Welcome to the Maricopa County Treasurers IRS Forms Page.

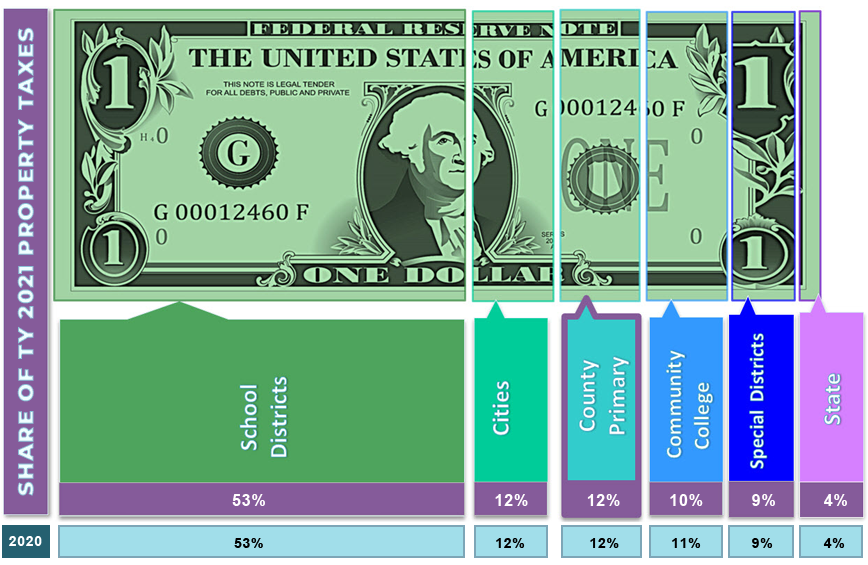

Enter the address or street intersection to search for and then click on Go. Sale Year Tax Year Parcels Advertised Value Not auctioned 1 Liens Sold Value Avg Int Rate 2 Struck to State 3 2019.

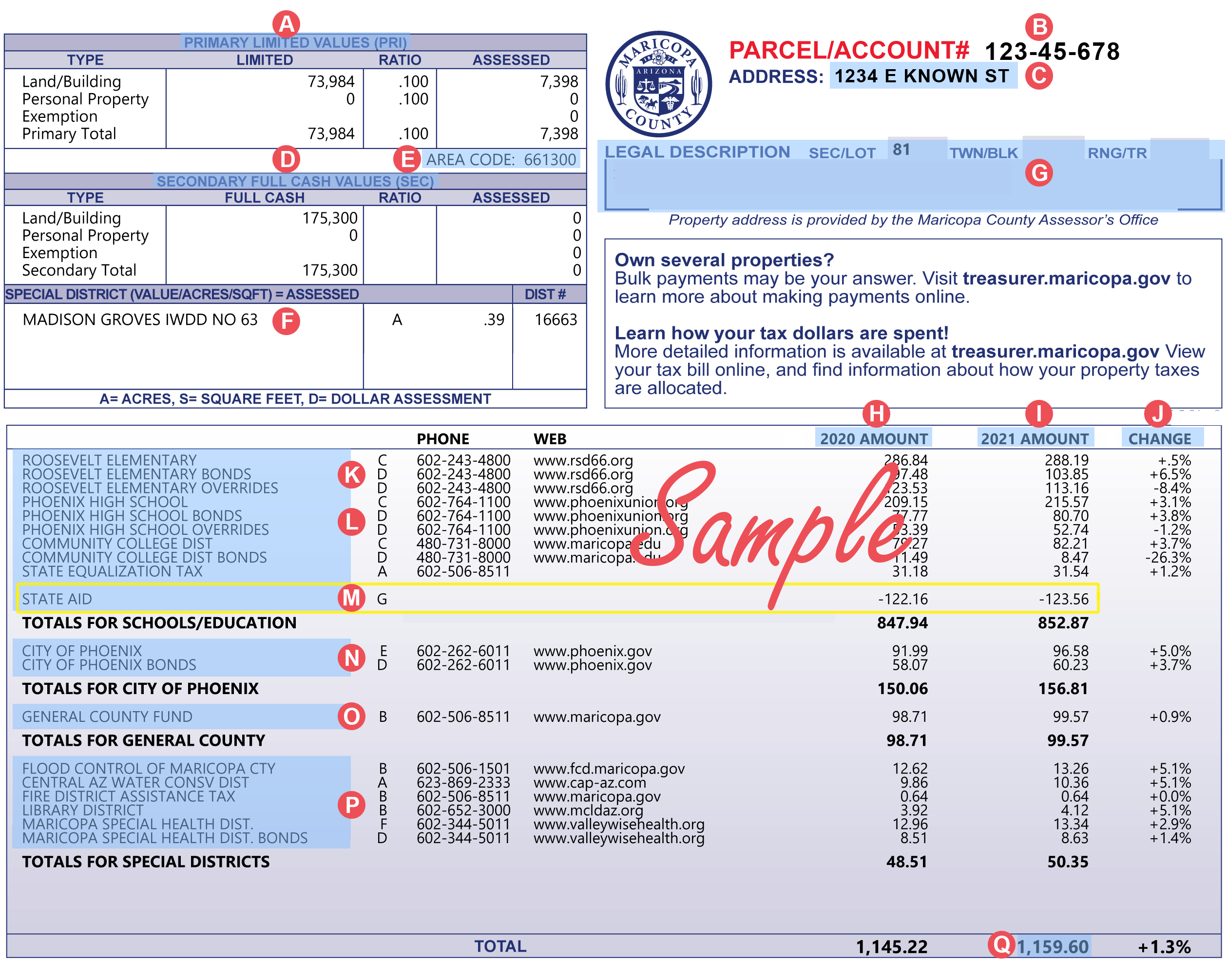

Maricopa County Treasurer S Office John M Allen Treasurer

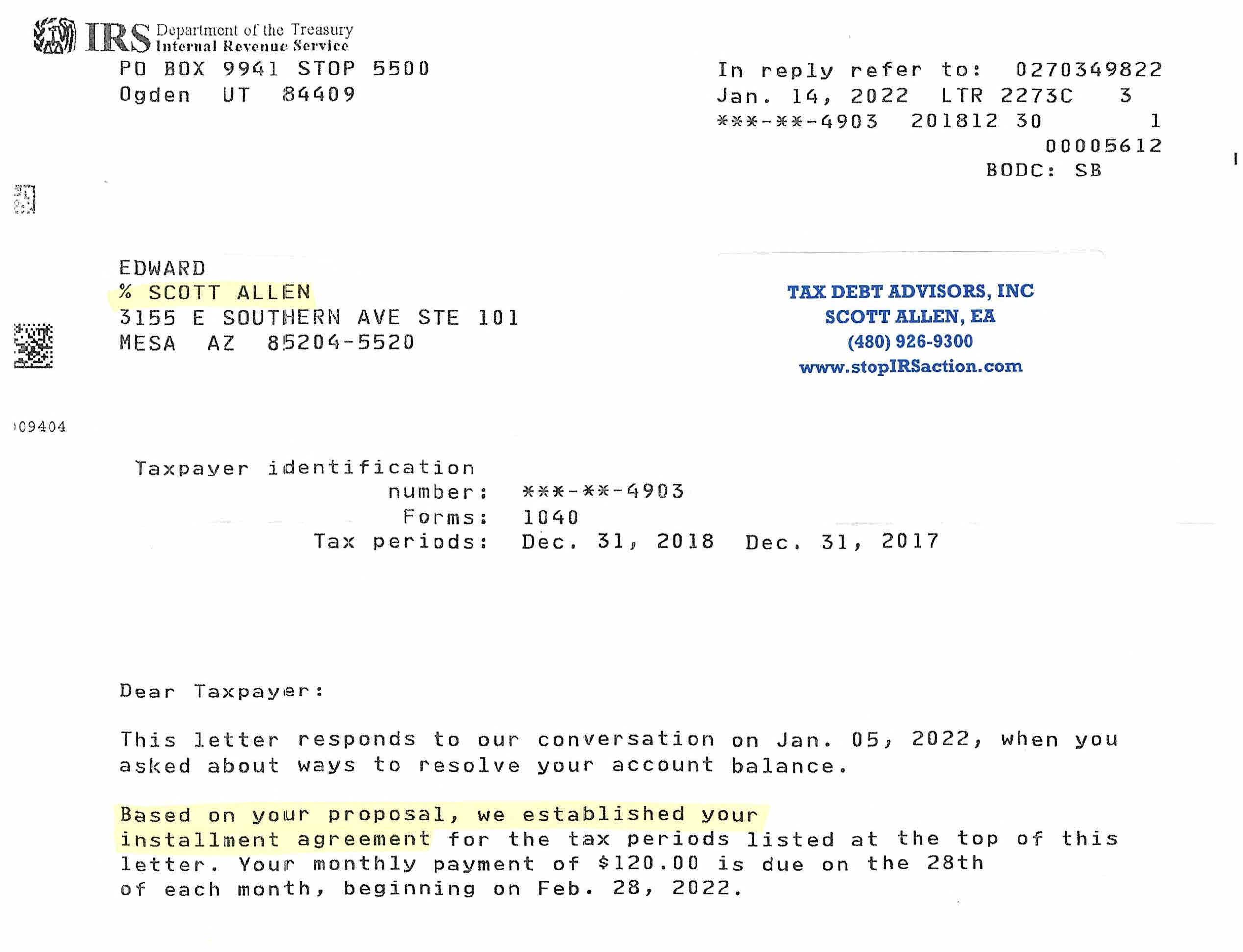

Irs Tax Payment Plan Tax Debt Advisors

Irs Tax Payment Plan Tax Debt Advisors

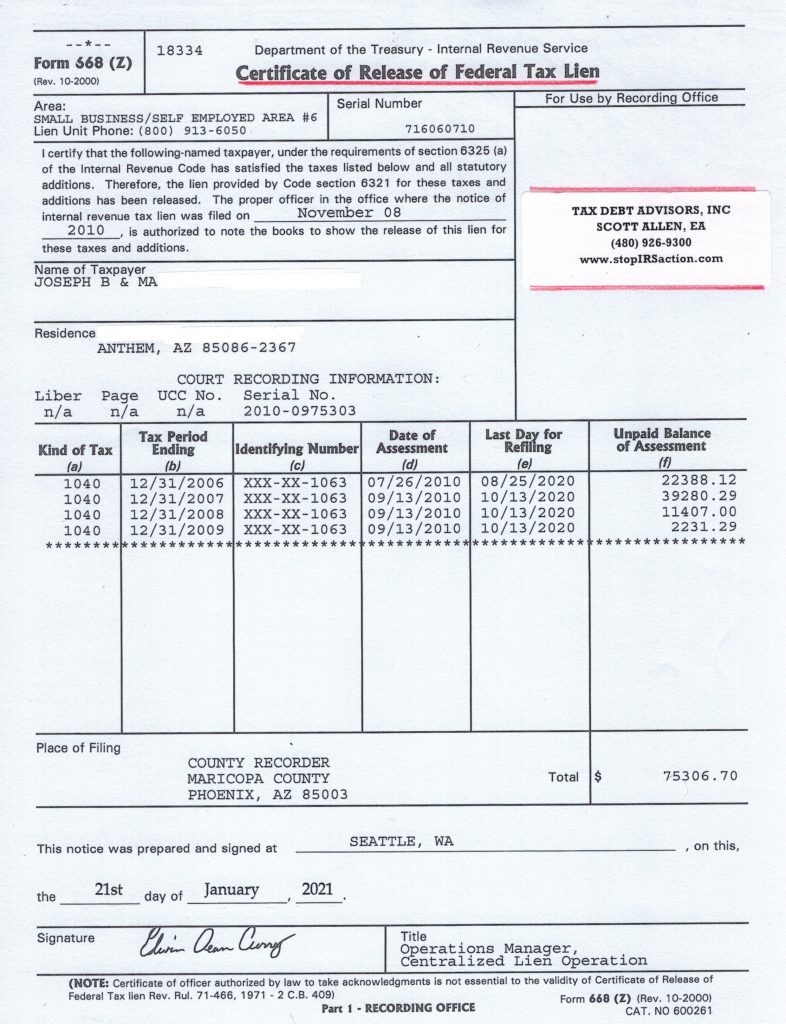

Maricopa County Tax Lien Foreclosure Process Best Reviews

Maricopa County Treasurer S Office John M Allen Treasurer

Irs Tax Lien In Arizona Irs Help From Tax Debt Advisors Inc Tax Debt Advisors